With this account you get. Fixed deposit also known as FD in Malaysia is an account that promises the investor a set rate of interest in return.

Fixed Deposit Malaysia Interest Rates Calculation Youtube

The fixed deposit with the highest interest we could find was the Affin Bank Term Deposit-i at a rate of 4 while the lowest interest rate was.

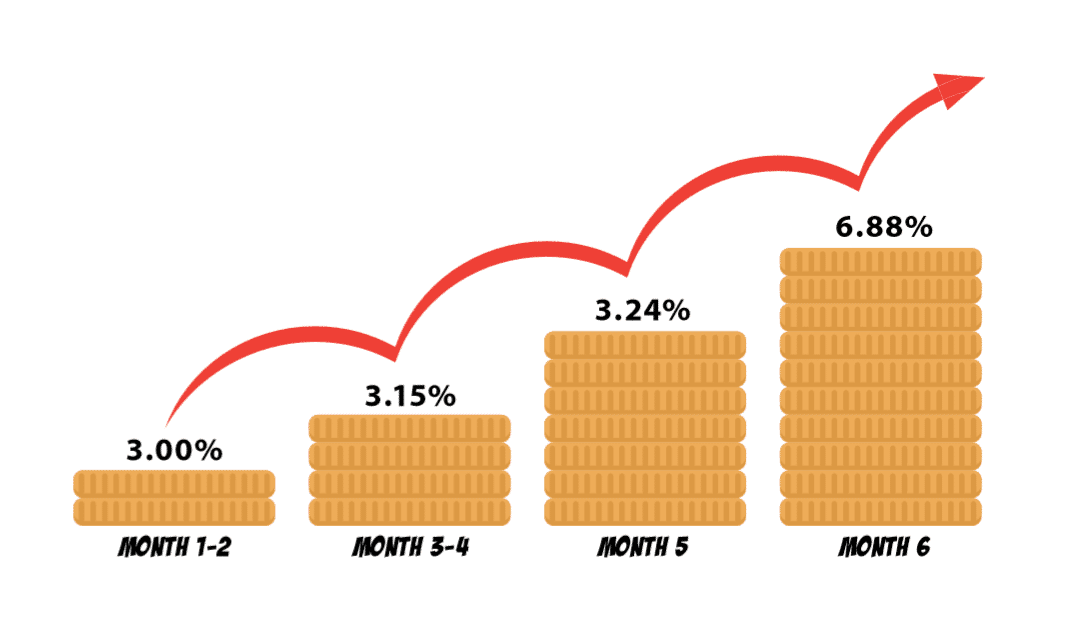

. These loan and project assets include green financing sustainable infrastructure projects microfinance and access to finance for. The longer the tenure the higher the interest rate is given. Sustainable Fixed Deposits are a conventional fixed deposit product which allows clients to have their capital referenced against qualifying loans and projects of Standard Chartered.

These requirements make fixed deposits less of a viable option especially during this pandemic when emergency funds are more important than ever. Hong Leong Fixed Deposit. Fixed Deposit is a type of investment account that allows you to invest a lump of money for a fixed time period and at a fixed rate of interest.

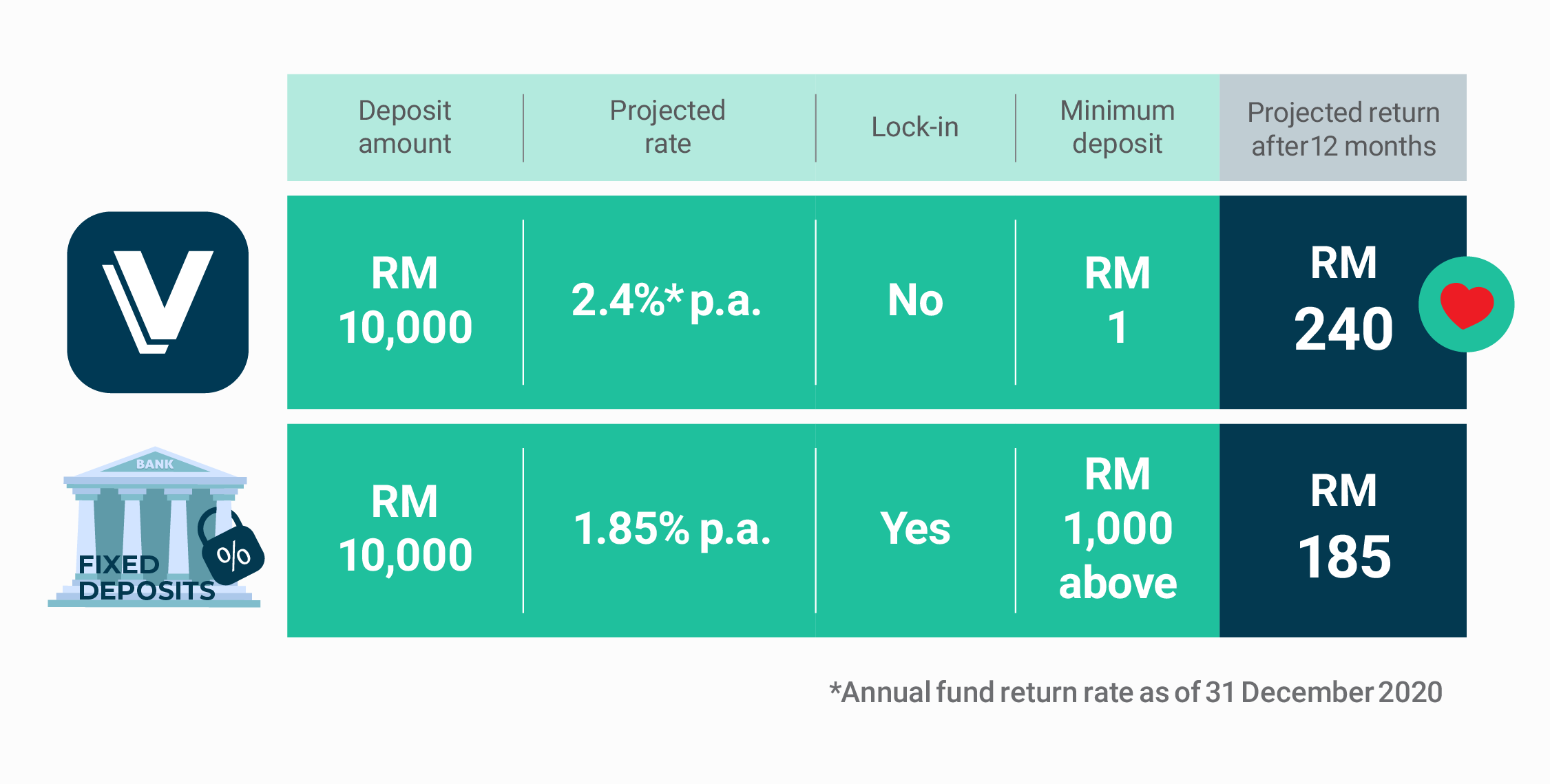

Fixed deposit accounts offered by CIMB are a prime example. Earn higher rates with Versa than fixed deposits out there. It is calculated on yearly basis unlike savings account which is calculated on daily basis.

Currently the best fixed deposit in Malaysia has an interest rate of 18 with lock-in period of up to 12 months and with a high minimum deposit. Theres a reasonable minimum deposit level of MYR500 for all but the very shortest of FD tenure and your funds are PIDM protected up to MYR250000 per depositor. The minimum amount for a fixed deposits in Malaysia is around RM 5000.

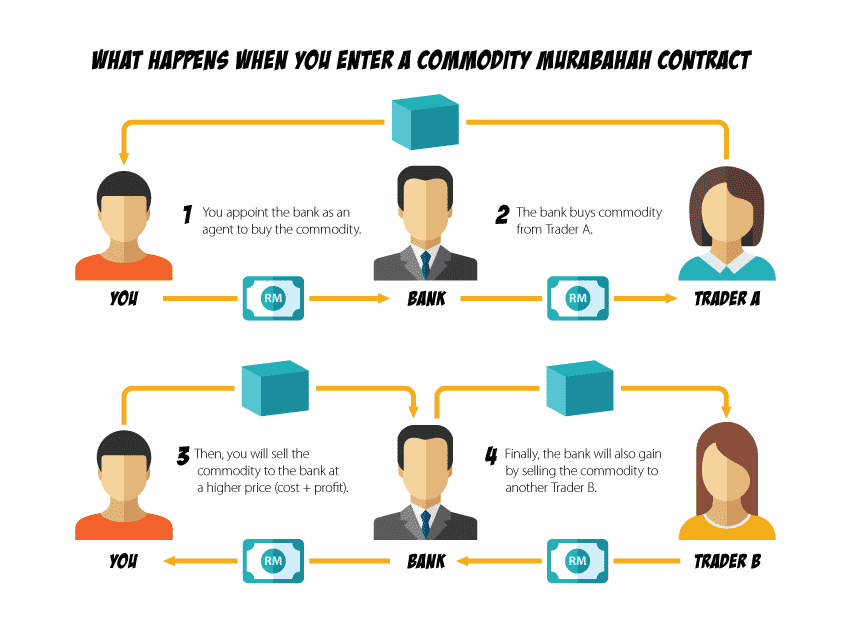

Heres another way to look at it. Higher profit rates than a normal Islamic savings account. Islamic Term Deposits based on the Shariah concept of Commodity Murabahah cost-plus-sale where a specific asset as deemed fit by the Bank is identified and used as the underlying asset for the sale and purchase transaction between Bank and Customer.

As you can see there is a wide difference between the lowest and highest interest rates offered in Malaysia. Youd have to put up a much higher deposit in your fixed deposit today to earn as much as you would have if you invested in the markets. However for fixed deposits you are only advised to.

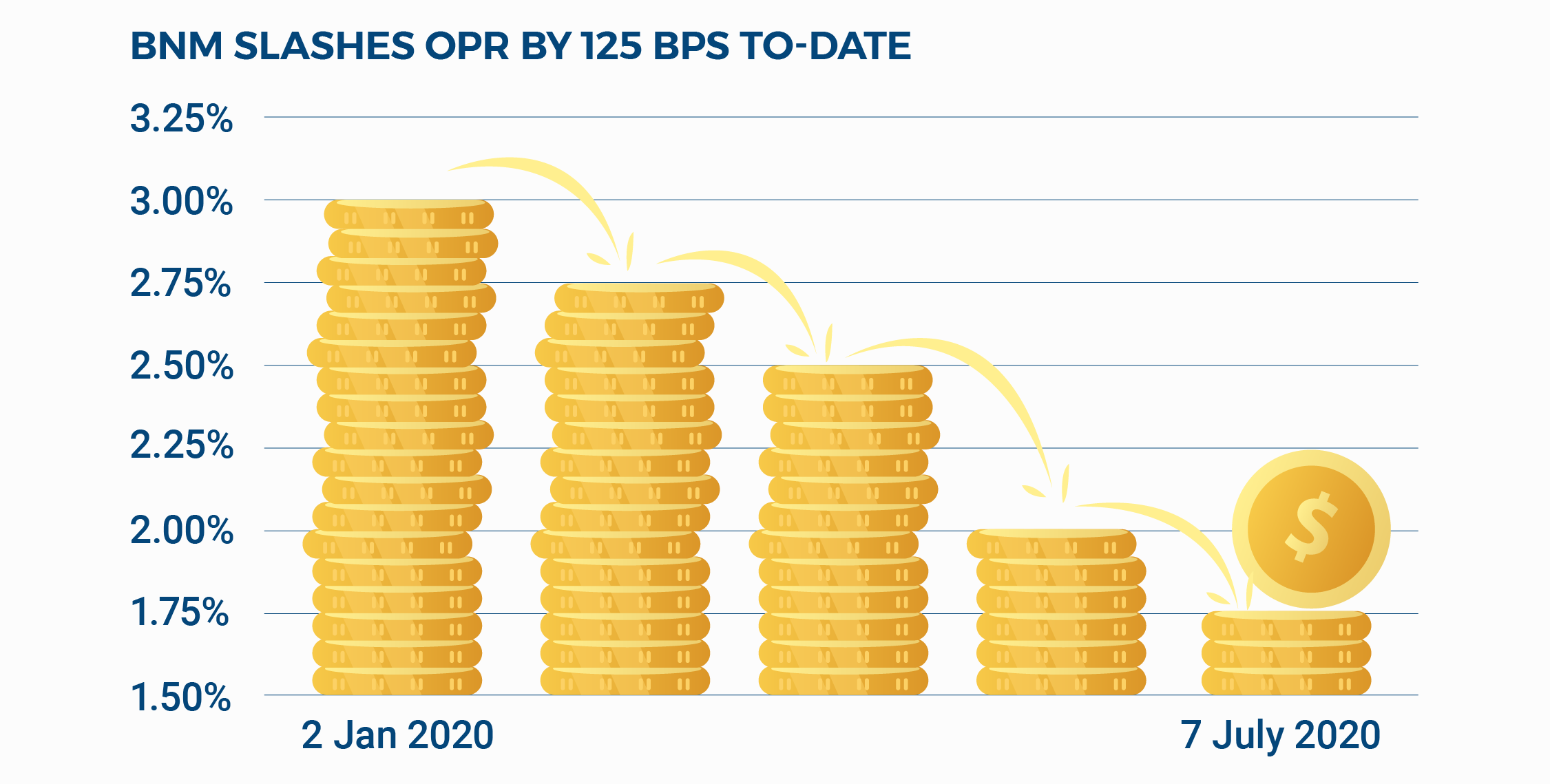

There are plenty of fixed deposits in Malaysia that are open to Malaysian citizens permanent residents and foreign applicants. This drop is due to the reduction in the overnight policy rate OPR set by the Central Bank of Malaysia BNM. Its quite popular because its known to be risk-free and has higher interest rates when compared to a regular savings account.

With effect from 1 January 2019 Effective Date the new premature withdrawal rule for all existing renewed and new placements of Conventional Fixed Deposit are as follows -Immediate Fixed Deposit Premature Withdrawal Without 31 days Notice Period No interest shall be paid on any immediate fixed deposit premature withdrawal Without 31 days Notice Period that. To get RM160000 in 20 years in a fixed deposit youd have to put up RM107000 today whereas youd only need to invest RM50000 in the markets to get to that same amount in 20 years. What is a Fixed Deposit FD In the Malaysian context FD is an investment-like product offered by the banks.

The difference between a conventional savings account and a FD account is clear. Fixed deposits generally require at least an RM1000 deposit but the BSN Term Deposit accepts as little as RM500. You might earn higher interest rate from some banks during their promotional period normally in.

Fixed deposits are regarded one of the greatest investment alternatives for consumers seeking good steady returns without being exposed to volatile market risk. FDs provide a higher rate of return than any other type of savings account but the benefits of keeping your money in an FD extend far beyond the high rate of return. Generally for a 12-months tenure term deposit account the interest rate ranges approximately between 3 to 4 per annum.

It also offers relatively. On top of that you need to lock away your cash for a fixed period to earn the full rate of interest. It is an account where you will place your money to earn interest over a set period of time aka.

Foreign applicants could also apply for Foreign Currency Fixed Deposits. These deposits are usually available for tenures of up to 12 months. For conventional savings accounts you are able to withdraw money at any time.

The Ordinary Fixed Deposit account from RHB has a broad range of tenure options from a single month right through to 5 years. Longer deposit terms come with a negotiable interest rate.

Fixed Deposit Rates In Malaysia V No 15

What Is A Fixed Deposit And How Does It Work

Malaysia Deposit Interest Rates 2020 Statista

Best Fixed Deposit Promos Malaysia 2022 Updated Weekly

Versa Vs Best Fixed Deposits In Malaysia Which Offers Higher Rates Versa

What Is A Fixed Deposit And How Does It Work

Best March Fixed Deposit Rates Up To 3 18

The 5 Best Fixed Deposit Accounts In Malaysia 2022

Best Fixed Deposits In Malaysia 2022 Compare And Apply Online

Versa Vs Best Fixed Deposits In Malaysia Which Offers Higher Rates Versa

Intheknow Retail Negotiable Instruments Of Deposit The Edge Markets

Fixed Deposit Rates In Malaysia V No 15

Rate Of Return Of Fixed Deposit And Asb Download Table

Best Fixed Deposits In Malaysia 2022 Compare And Apply Online

Fixed Deposit Malaysia All You Need To Know Youtube

9 Questions About Fixed Deposit To Ask Before Investing

Versa Vs Best Fixed Deposits In Malaysia Which Offers Higher Rates Versa

Fixed Deposit Rates In Malaysia V7